For over two decades, the production tax credit (PTC) has served as a vital incentive fueling growth across America’s renewable energy landscape. But the complexities of monetizing these credits have often constrained their upside for project developers. Recent reforms now establish a marketplace allowing developers to sell unused PTCs, unlocking new pathways to derive value from renewable assets. In the months since these changes, an emerging secondary market has rapidly begun providing initial data points around supply, demand and asset pricing. While risks inherent to production variability still weigh on valuations, we expect to see spreads compress over time as market liquidity grows. Developers able to capitalize on dynamics in these early days will have a competitive advantage in financing projects.

A Primer on Production Tax Credits

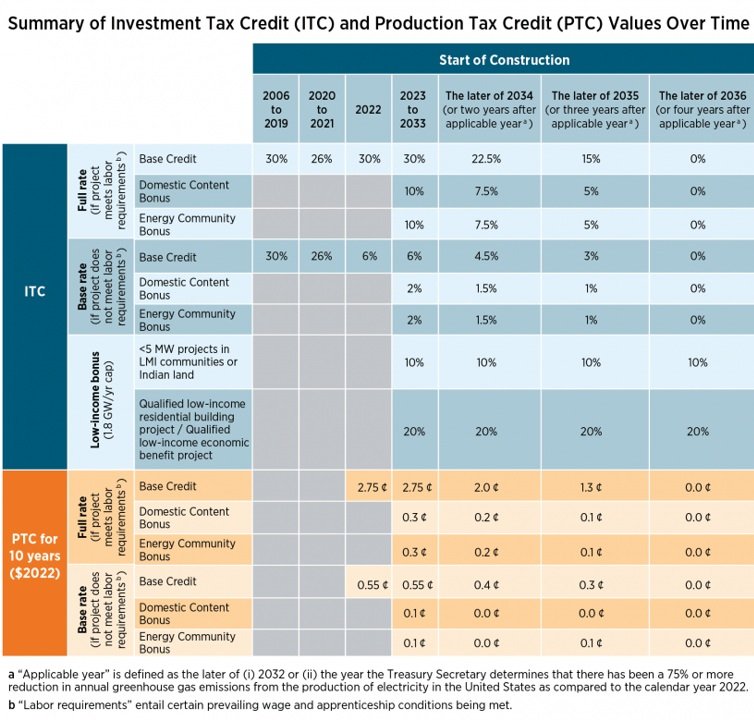

- The PTC provides developers a tax credit for each megawatt-hour (MWh) of electricity generated from qualifying renewable sources like wind and solar. The credit value adjusts annually for inflation and today equals around 2.6 cents per kWh.

- Eligible projects receive the PTC for the first 10 years of operations after being placed into service. However, it has historically been challenging for developers to directly utilise the full value if they lack sufficient taxable income.

- The Inflation Reduction Act (IRA) in 2022 extended the PTC for 10 years. It also enabled developers to transfer unused credits to third-party buyers, opening up new monetisation avenues.

PTC Dynamics Pose Distinct Challenges

Unlike the Investment Tax Credit (ITC) earned upfront, the production-based nature of PTCs introduces unique risks and uncertainties that impact financing:

- Generation depends on variable factors like wind patterns and solar irradiation that affect output. Production may underperform forecasts, reducing PTC value.

- Operational issues could force shutdowns curbing production. Without output, no PTCs are generated.

- If projects cease operations earlier than expected, future PTC eligibility is lost.

These factors make modeling PTC volumes challenging. They also expose buyers to greater risks relative to ITCs, weighing on pricing in the secondary market.

Understanding the Tax Credit Transfer Mechanics

The IRA’s transferability provision fundamentally expanded the liquidity of PTCs. Here is a brief overview of how sales to third-party buyers can now work:

- Developers forecast their project’s PTC generation over the 10-year eligibility window based on production models.

- Any portion of the estimated credits can be sold to buyers through bilateral contracts or via secondary market exchanges.

- Sales typically occur as one-year forward contracts, with the buyer providing payment once credits are earned.

- Buyers can then utilise the credits to offset their own federal tax obligations. Credits can only be sold once.

- Required filings must be submitted to the IRS to properly document all transactions.

For developers, this unlocks new revenue streams, provides capital flexibility, and reduces financing costs. The trick is securing attractive pricing given the inherent risks involved for buyers.

Emergence of a Secondary Market for Production Tax Credits

In the months since transferability was enacted, financial institutions, insurance firms, corporations, and other large taxpayers have begun positioning as buyers. While still early days, initial data points on credit pricing are emerging:

- In bilateral sales, PTC pricing has ranged from approximately $0.85 to $0.90 per $1 of tax credit according to industry sources.

- On secondary market exchanges that have launched, trades during the 4Q2022 contracted period cleared between $0.87 to $0.89 per $1.

- Total volume traded has surpassed $100 million across over 100 projects according to exchange operators.

What’s driving this discounting from face value? Primarily production uncertainty and the risks borne by buyers:

- PTCs are only generated as electricity is produced. Lower than forecasted generation reduces credits.

- Buyers must still pay fully contracted amounts even if credits fall short, and they incur clawback penalties if credits are overstated.

- There is also exposure if a project ceases operations earlier than expected.

In a survey by RenewableAssets.com, 78% of developers indicated they would only be willing to sell PTCs at $0.90 or higher, while 82% of potential buyers said they would not exceed $0.85. This difference in perceptions shows the tension in early pricing negotiations.

The Role of Volume, Tenor and Project Stage

In a young marketplace, activity remains concentrated in smaller volume trades for operational projects, reflecting caution by participants across this new asset class.

- Most trades have been under $5 million in size, with a notable uptick in $10-$20 million trades in early 2023 according to GenPowerX.

- Maturities concentrate in the 1-2 year range as buyers and sellers look to mitigate risks.

- Operational projects make up over 90% of transactions as they have production history, though advanced development assets are beginning to trade.

As familiarity with PTCs increases, we expect to see growing appetite for larger deals, longer tenors, and earlier stage project collateral. But developers able to structure such bespoke transactions currently enjoy attractive pricing leverage.

The Path to Narrowing Valuation Spreads

In any nascent marketplace, perceived risks are amplified and valuations widely dispersed. But over time spreads typically compress as products become more standardised and participants more comfortable transacting.

Several catalysts point to eventual convergence in PTC pricing nearer to the $0.90-$0.95 range:

- Volume begets liquidity – Higher trading activity will spawn bids on both sides.

- Data accumulation – Buyers and sellers will refine risk models as production histories grow.

- Term evolution – Longer maturities shift trading towards project life assumptions.

- New instruments – Derivatives like put options can transfer operating risk from buyers.

- Rating enhancements – Credit wraps or project ratings decrease counterparty risks.

- Exchange innovation – Centralised platforms and clearing smooth price discovery.

As PTCs transition from a novel asset to established commodity, we foresee spreads tightening materially. But uncertainty inherent to generation profiles limits full convergence absent other product innovations.

Implications for Project Developers and Financing Strategy

For renewable energy developers, the emergence of a PTC marketplace is undoubtedly positive in opening up low-cost financing alternatives. However, those looking to maximise value should be deliberative in crafting their monetisation strategy.

Key considerations include:

- Pursuing operational power purchase agreements to ensure predictable revenues once projects are online. Cash flows are crucial to servicing any future project level debt.

- Seeking credit support from high quality sponsors to improve financing terms and PTC pricing.

- Partnering with active secondary market firms to streamline trading and achieve better clearing prices.

- Exploring instruments like put options that contractually transfer production risk away from the PTC buyer.

- Optimising partnership structure for future flexibility between tax equity, back leverage, and PTC sales.

- Maintaining conservative assumptions around future generation and life of operations.

The PTC marketplace’s evolution will also impact sponsors’ underwriting models. As asset pricing normalises, required project returns may fall expanding the number of economically feasible sites.

Unlocking the Full Value of PTCs

48fund offers dedicated support to help renewable developers reliably monetize their tax credits at optimal pricing. Our full-service platform makes selling PTCs easy by providing:

- Access to a nationwide network of qualified tax equity investors, corporations, intermediaries, and other buyers

- Advisory services and transaction support to handle IRS compliance requirements

- Forecasting tools to model potential PTC generation across project portfolios

- Exchange infrastructure to efficiently transact and achieve fair clearing prices

- Risk management partnerships to help developers transfer production risks away from buyers

By working with 48fund, developers can maximize their PTC monetization to finance new clean energy projects.

While still early days, developers able to understand the dynamics of this rapidly growing secondary market for production tax credits will have an edge in profitably financing renewable projects. Those that act as first movers while pricing remains widely dispersed stand to benefit most in both absolute margin and strategic positioning. But regardless of where spreads settle over the long-term, deep liquidity unlocks value across the industry by ensuring production tax credits can be seamlessly translated into upfront capital for new projects.